Bitcoin Mania stage starts in February 2025

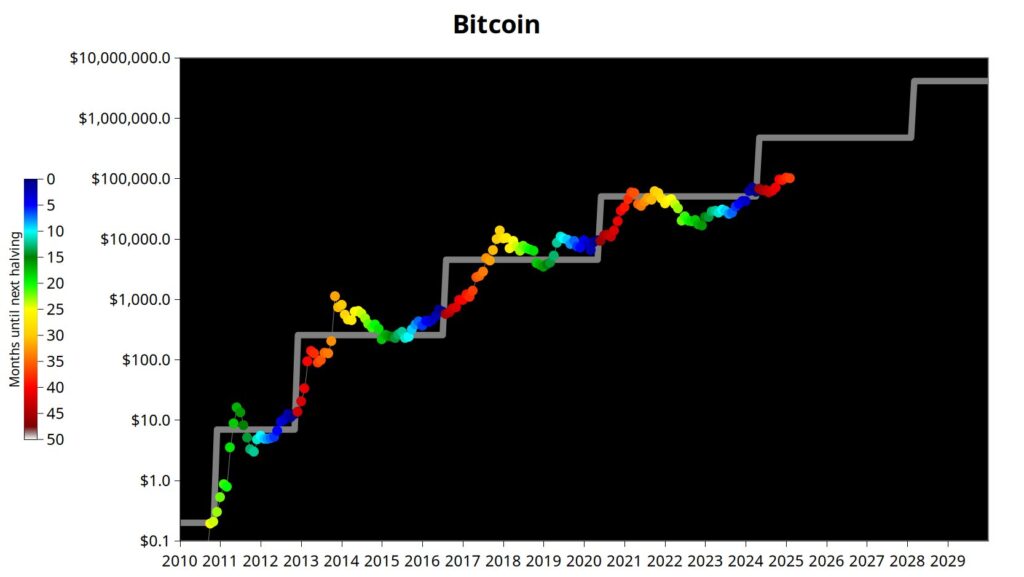

Popular chartist Plan B has posted an interesting stock to flow model that indicates that we are now entering second stage of the bull market. Whenever the chart prints orange dot after a red one, the bitcoin mania stage starts.

In our opinion, it is certainly the weakest red – let’s hope orange perks up a little, although it is hard to complain at 100,000 a coin. The last year and a half looks like slow grind up. This could be the end of the deep correction in the four year cycles.

As we approach the second stage of this bitcoin cycle, it’s essential to remain vigilant and adapt to changing market conditions. The diminishing returns are very clear on this chart. The peaks are less and less steep, like they are falling.

As you can see, 2013 and 2017 are quite similar, but 2021 bull market got killed by China’s mining ban in May 2021 – 50% of bitcoin hashrate was shut down overnight and had to be relocated, mainly to the US.

🔴->🟠

Almost 1 year since the halving, bitcoin red dots are turning orange (and then yellow): entering the 2nd stage of the bull market, the steep FOMO stage.🚀 pic.twitter.com/9g9UMzMYma

— PlanB (@100trillionUSD) February 5, 2025

Plan B believes stock to flow model seems to imply the end of the US dollar at some point in the future. He thinks either USD will die or Stock to Flow will die. He adds, historically USD has had a very long run as reserve currency, so, in his opinion, it is not unthinkable to have it replaced by a world reserve currency something.