Maker DAO vault paid 65000 in Ethereum to pay off debt

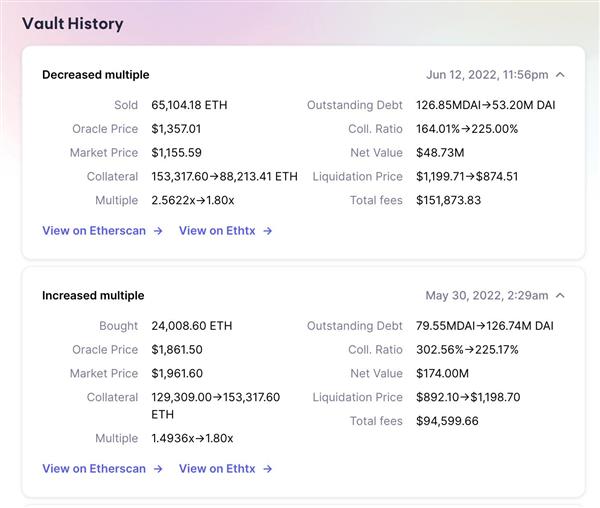

In recent news, a Maker DAO vault had to pay whopping 65,000 in Ethereum cryptocurrency just to pay off its debt and decrease their risk. All this has profited 150,000 dollars in fees to Oasis.app. The Ethereum was sold at an average price of 1155 dollars, which is considerably lower than Ethereum’s current price of ~$1350. Here’s the screenshot of vault history.

One may think that Maker DAO lost 13-million dollars due to poor trade execution since they sold their Ethereum ~$200 below market price. Or, maybe they believe it is intelligent to sell now rather than loosing lately. It does not take a genius to figure out that Ethereum and other cryptocurrencies are in free fall.

One must not confuse this with a liquidation event. It was, infact, a debt payoff. And this is what happens in poorly designed Ethereum DAPPs that do not adjust to economic pressure and instead allow a build up those forces, firesale type actions like this. The DeFi system has much to learn from the last few months.

At 11:56 am (UTC+8) $WETH/$USDC down to $941 may relate to a Maker DAO Vault sold 65k $ETH to pay off debt.