Bancor 2.1 live on Ethereum blockchain

Bancor v2.1 has passed the community vote earlier today and is now live on Ethereum mainnet.

Finally, LPs can stake with single-sided AMM exposure – while earning fees & protection from impermanent loss. REN is among the first protected pools live, with 60+ pools going live in the coming days.

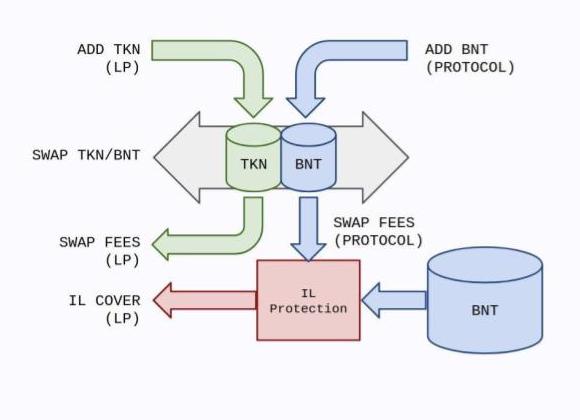

When adding liquidity to the pool, choose between 100% exposure to REN or 100% exposure to BNT. Manage your protected positions in Bancor’s new pool manager.

Single-sided exposure + IL insurance + swap fees = higher ROI on collected fees. How does it work?

Provide liquidity to a pool and the Bancor protocol co-invests with you by – providing the opposite side in BNT. The protocol earns BNT fees, which are burned to pay for IL insurance and reduce the overall BNT supply.

This is the 1st upgrade passed by Bancor’s new governance framework and brings a new level of sophistication to AMMs.

Bancor is grateful to have a community of brilliant minds already proposing new ideas, voting for new pools & fine-tuning the system.

Single-sided exposure & IL insurance aim to make AMMs less chaotic & more predictable for Liquidity pools, who can now:

Long the token they want

Earn from swap fees

Set it & forget it

No more:

stress being an Liquidity pool

getting rekt by imp loss

misleading APYs