TrueFi issues Blockwater notice for $3.4M restructured loan

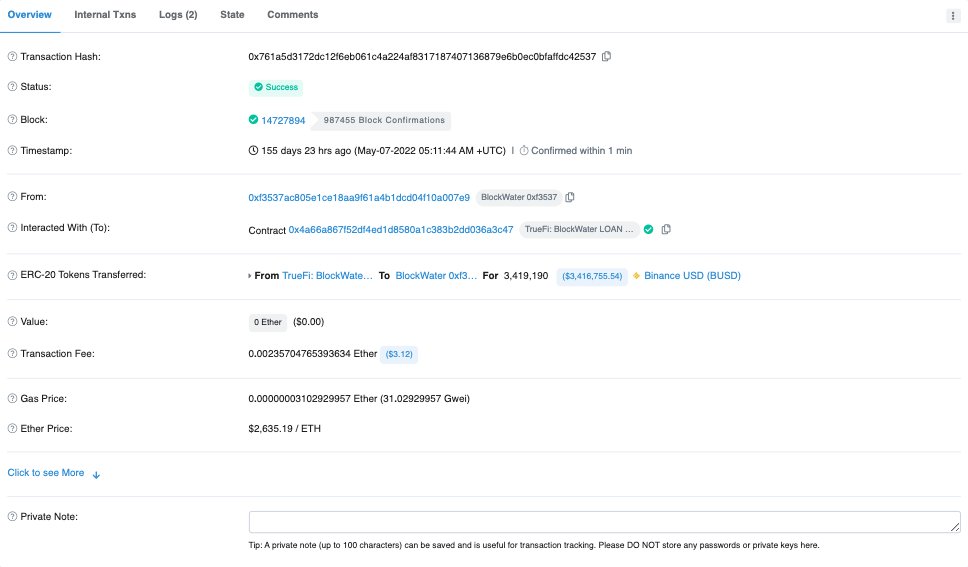

TrueFi DAO has issued a default notice to Blockwater Technologies for non-payment of $3.4M restructured loan. Out of this loan, the default represents around 2-percent of total value of TrueFi’s DAO. Blockwater Technologies and NWH/Invictus loans represent a total of 0.25% TrueFi’s cryptocurrency loan originations. It shall be noted that this would have no effect of USDC, USDT and TUSD pools of TrueFi. Here’s screenshot of the loan that was taken on Ethereum blockchain around 155 days back.

The credit team at TrueFi DAO says as result of active negotiations expected recovery value will be maximized on these distressed loans. We believe because of the real active small size of the default, it puts an opportunity for raising the bar in quality standards, and allows for an amazing opportunity for us to learn about on-chain credit.

They are leading an exhaustive out of court workout with Blockwater’s principals. This includes a loan amendment that would increase the borrowing rate and also extend the maturity. This would ensure supervision by court that would ensure better outcome for the stakeholders. There is a lot of complexity around sudden insolvency of Blockwater Technologies.

The TrueFi credit team adds that as result of active negotiations expected recovery value will be maximized on these distressed loans.

Official @TrueFiDAO statement on Blockwater default: https://t.co/3bEeFCoOWt

— TrueFi (@TrueFiDAO) October 9, 2022

NWH/Invictus has also entered a Cayman voluntary liquidation proceeding and may not repay its $1.0m loan that is due on 30th October 2022.